How Seevcash Achieved 400% TVL Growth in One Week With DeFindex

A Ghanaian fintech integrated production-ready DeFi yields in 1 week instead of 12+ months, then watched TVL spike 433% following marketing activation.

| Metric | Result |

|---|---|

| Integration Time | 1 week (vs. 12+ month in-house estimate) |

| TVL Growth | 433% in one week post-marketing launch |

| Code Reduction | 50%+ through SDK adoption |

| Time to White-Label | 6 weeks from launch to first B2B partner |

Seevcash is a mobile-first fintech platform serving Ghana's underserved markets, where 40% of the population remains unbanked but mobile penetration exceeds 140%. The company's mission centers on payment accessibility - including a unique feature where users watch ads to offset transaction fees, removing barriers where every cedi matters.

Recently awarded Stellar Foundation marketing grants, Seevcash needed competitive yield features to retain users in West Africa's fast-moving fintech landscape. Without them, users would migrate to competitors offering returns that outpace local inflation.

Seevcash's users were clear: they wanted competitive returns on stablecoin holdings. But the technical reality was daunting.

Patrick, Seevcash's lead engineer, described the core problem:

"Most wallet builders don't know smart contracts. For us, it's very time-consuming to develop something like this. We don't even see the solution until someone shows us it exists."

The barriers were threefold:

Building comparable infrastructure in-house would require 12+ months: learning Stellar smart contracts, building vault infrastructure, conducting security audits, and implementing sponsorship flows. For a small team focused on core wallet features, that timeline was impossible.

The team would need to understand underlying DeFi protocols, assess liquidation risks, create rebalancing strategies, and handle ongoing protocol monitoring - expertise far beyond their core competencies.

Users would need to acquire XLM for gas fees - a deal-breaker in markets where even small amounts matter. Without Stellar's sponsorship flow, each transaction would require users to manage blockchain complexity directly.

Dawit, Seevcash's founder, summed it up:

"Time is the main problem. Even if we had the capability, dedicating that much engineering time means delaying everything else our users need."

At Stellar's Meridian Conference in Rio de Janeiro (September 2024), the Seevcash team discovered DeFindex offered battle-tested yield infrastructure they could white-label in days.

Patrick's team integrated DeFindex's REST API immediately after returning from Brazil. The API handled complex DeFi interactions behind the scenes - automated deposits into Blend Capital, real-time APY calculations, secure withdrawals, and smart contract risk management.

"I remember arriving back in Ghana and showing Esteban, 'Hey, we actually have the integration done.' It took us one week."

As adoption grew among internal testers, the team migrated to DeFindex's SDK to leverage Stellar's sponsorship flow - eliminating gas fees entirely.

The impact was immediate. "The SDK cut our codebase by more than 50%," Patrick explained. "The workload is handled by DeFindex. We just take advantage of the simplicity."

What the SDK enabled:

- Zero gas fees for users through sponsored transactions

- One-tap deposits and withdrawals with complexity abstracted completely

- Dramatically reduced code with fewer potential bugs

- Example repositories that turned multi-day implementations into hours

Patrick was emphatic: "Looking at the current integration we have now, that should be a day's work. It's plug and play."

Traditional approach: 12+ months estimated

DeFindex approach: 1 week initial, 1 day with SDK templates

The difference freed Seevcash's engineering team to focus on features that actually differentiate them in the Ghanaian market.

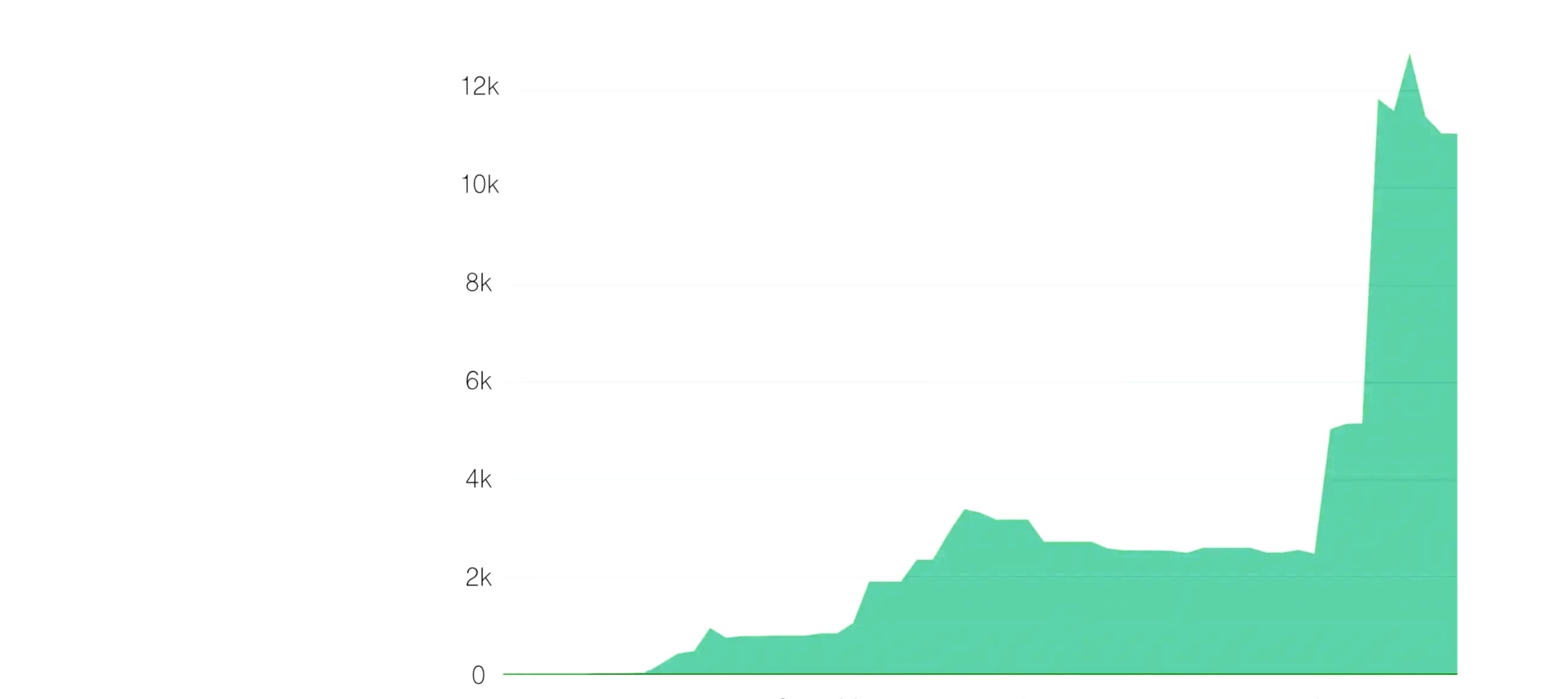

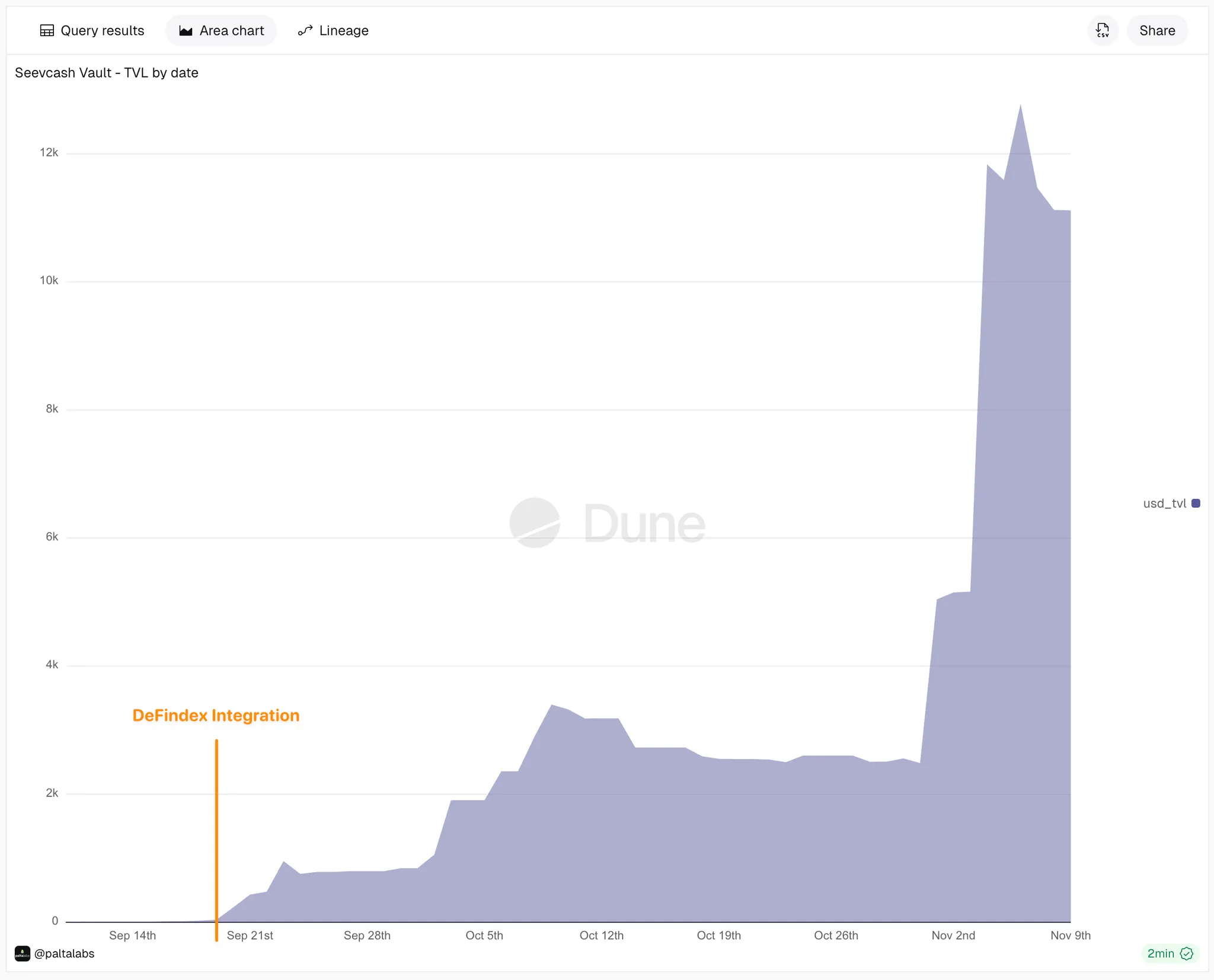

After six weeks of internal testing, Seevcash activated marketing in early November 2024. The results were immediate.

- Sept 14 - Nov 1: Steady $2-3K baseline during internal validation

- Nov 2-9: Explosive growth to $13K peak (433% increase)

- 24 active users earning yield across income levels

- No minimum investment required - true accessibility

The numbers tell only part of the story. In emerging markets, trust matters more than APY.

"I've had every single person who deposited ask me, 'Is it real?' When they see the money adding up after just five minutes, they always ask. I tell them, 'Yeah, you can withdraw it as well.' That builds trust immediately." — Dawit, Founder

The ability to deposit small amounts, see real-time earnings, and withdraw instantly transformed skepticism into confidence.

Before external marketing launched, Seevcash had their own validation metric.

"For me, the metric to know we're building something very good is when my co-founders and engineers begin using it just like me. When I realized Patrick is now keeping his money in his wallet, I knew other people would use it too." — Dawit, Founder

The signal proved accurate. Seevcash's CTO now holds over $4,000 in the platform - significant savings in the Ghanaian context.

Within six weeks of launching yield features, a financial services partner in Ghana approached Seevcash wanting to white-label the same integration.

"We already have a client who wants this integration through their platform, then to DeFindex. We've already started onboarding third parties." — Patrick, Lead Engineer

This unsolicited B2B expansion proved three critical points: the integration is genuinely simple enough to resell, market demand is strong enough that competitors see the feature as necessary, and DeFindex's infrastructure model works at scale.

The SDK migration delivered unexpected engineering benefits beyond speed.

"We're less likely to create bugs now because the codebase is so much smaller and cleaner. The SDK made things much more streamlined." — Patrick, Lead Engineer

For a small team where every engineering hour counts, cleaner code means faster feature velocity and fewer production incidents that erode user trust.

To understand the value proposition, consider what Seevcash avoided building:

Smart Contract Infrastructure: Vault management, strategy logic, emergency rescue functionality, role-based access controls

Protocol Integration: Connecting to yield sources, monitoring protocol health, handling upgrades, rebalancing when yields shift

User Experience: Stellar sponsorship for gasless transactions, real-time APY calculations, transaction history, secure withdrawals

Ongoing Maintenance: Security monitoring, protocol evaluation, SDK updates, documentation

DeFindex handles all of this, letting Seevcash focus on accessible financial experiences for Ghanaian users.

Seevcash transformed a 12+ month infrastructure project into a one-week integration, achieved 433% TVL growth in one week following marketing activation, and signed their first white-label partner within six weeks.

The difference? Recognizing that yield infrastructure should be a commodity, not a competitive advantage.

"I think what makes our partnership work isn't just the product or the yield. It's that Esteban and Francisco can be trusted. Business is built on trust. Everything else is a bonus." — Dawit, Founder

See how DeFindex can help your platform offer competitive yields without the development overhead.

About Seevcash: A Ghanaian fintech platform democratizing financial access through mobile-first experiences. Recently awarded Stellar Foundation marketing grants for West African expansion.

About DeFindex: White-label yield optimization infrastructure on Stellar, enabling wallet providers to offer competitive DeFi yields without building complex infrastructure in-house. Built by PaltaLabs, backed by Stellar Community Fund.